Appendix D

Common Fraud Crimes and Tips for Reducing

Revictimization

The term "fraud" does not describe just one crime. It is, rather, a catch-all phrase used to describe any number of criminal acts designed to deliberately deceive consumers with promises of goods, services, or other financial benefits that do not exist, were never intended to be provided, or were misrepresented. The number of fraudulent schemes (and their variations) is limited only by the imagination of fraud perpetrators. This appendix is designed to provide victim/witness coordinators with a general overview of the most commonly perpetrated fraudulent schemes and practices. This list is not intended to include all fraud crimes, but it will alert victim/witness coordinators to some of the crimes encountered by the victims they serve.

Each fraud crime overview is followed by information to help victim/witness coordinators understand who the targeted victims are, along with some simple consumer protection tips and suggestions that coordinators may wish to relay to victims to help decrease the risk of repeat victimization.

Overviews are provided for the following fraud crimes:

Shorter overviews are provided for the following fraud schemes:

Additionally, at the conclusion of the appendix, a list of consumer protection agencies, their contact numbers, and samples of fraud-related resources are provided. Victim/witness coordinators may wish to contact the listed agencies to order free publications and fraud alerts that can be used in public awareness campaigns, distributed to fraud victims, and handed out at criminal justice-based and community-oriented training events.

A.Most Common Forms of Fraud

1.Advance Fee Schemes

The common definition of an advance fee scheme is one where a fee is secured in advance for products or services that will be provided at a later date but that, in fact, the fraud criminal does not intend to provide. These are some of the more common advance fee schemes:

Commonly Targeted Victims

Once the advance scheme operator has bilked all the consumers he can in one location, he picks up his mobile shop and moves on to the next location.

Consumer Protection Tips

2.Bank Examiner Schemes

The perpetrator of a bank examiner scheme pretends to be a bank examiner or law enforcement officer (often producing fraudulent documentation to support his or her claim). The perpetrator contacts victims, normally by phone, and asks that they aid the bank or law enforcement agency in an internal investigation to catch a dishonest bank employee. The targeted victim is then asked to withdraw money from his or her bank account (so as not to raise the suspicions of the dishonest bank employee) and to give the money to the perpetrator, who will record the money's serial numbers or mark it so that when it is spent by the dishonest bank employee, it can be traced easily. Once the perpetrator receives the money, he or she is never seen again.

Commonly Targeted Victims

Typically the perpetrator obtains information about bank customers by approaching them directly or by observing written documents in the customers' possession, such as bank statements or check imprints. Sometimes the information comes from a confederate working in the bank.

Consumer Protection Tip

Banks and law enforcement officers do not enlist the help of customers or private citizens to catch embezzlers or thieves. They have internal security staff to handle such matters. Report any solicitation to the bank in question and to local law enforcement officials immediately.

3.Computer and Internet Fraud

This type of fraud is on the rise. As consumers and business owners become more dependent on computers to assist with running businesses and personal lives, the potential for computer fraud rises dramatically. Through the use of computers, fraud perpetrators can steal classified information, funds, client lists, copyrighted programs, consumers' personal information, and other valuable data. These criminals often sabotage computer systems by destroying data, entering inaccurate data, or planting a computer virus. With the increasing use of the Internet, fraud artists have yet one more means of contacting and defrauding consumers by selling nonexistent or shoddy merchandise and accessing personal information to perpetrate other crimes, such as identify theft and credit card fraud.

Commonly Targeted Victims

Consumer Protection Tips

4.Credit Card Fraud

Credit card fraud occurs when an unauthorized individual steals or otherwise obtains a consumer's credit cards or credit card information to obtain replacement or new credit cards. Once in possession of the new cards, thieves run up massive debt before leaving town to avoid detection. Here are some of the ways perpetrators obtain credit card information:

Commonly Targeted Victims

Consumer Protection Tips

5.Financial Planning Fraud

Changes in tax laws and a desire to plan ahead for retirement has caused more people to use the services of financial planners. However, the financial planning industry is virtually unregulated, thus creating a favorable climate for untrained, unlicensed, and unscrupulous fraud artist to set up shop and offer financial planning advice. At its best, financial planning fraud can position victims' holdings in unsuitable investments, resulting in substantial financial losses. At its worst, the money is collected but never invested. Once the perpetrator has collected enough money for his or her purposes or fears detection, he or she closes up shop and moves to another city or town or declares bankruptcy.

Commonly Targeted Victims

Fraudulent planners tend to target individual consumers looking for investment opportunities to increase their financial security--often younger consumers who are beginning to establish families and experience professional growth or older consumers concerned about retirement incomes.

Consumer Protection Tips

6.Health Care Fraud

The National Health Care Anti-Fraud Association defines health care fraud as intentional deception or misrepresentation designed to result in an unauthorized payment of health benefits to an individual, entity, or third party. The most common forms of health care fraud involve the filing of a bill for (1) health-related services or supplies that were provided only in part or not at all, (2) superior medical supplies when substandard supplies were used, or (3) unnecessary tests and procedures. Health care fraud crimes also include institutional fraud, which is committed by certain hospitals, laboratories, and clinics, all or part of whose basic business operation revolves around fraudulent acts.

Health care fraud also includes the selling of bogus health care products and treatments to consumers through direct mail and telemarketing venues. These bogus products and treatments may include medications, tonics, vitamins, or other gimmicks that guarantee the loss of weight, the growth of hair, loss of cellulite, or cures for such illnesses as cancer, arthritis, or AIDS.

Commonly Targeted Victims

According to the National Health Care Anti-Fraud Association, health care fraud places some patients at an increased risk for physical and emotional danger if the scheme involves using substandard medical products but billing for better, more expensive products. Examples of this may include using defective pacemakers or catheters during heart surgery, which can result in patient death, additional surgeries to replace defective or substandard products, and unnecessary tests and procedures that may increase fragile patients' risk of injury or death.

Consumer Protection Tip

7.Home Repair Fraud

Fraudulent home repair contractors use a variety of ploys to deceive homeowners into paying substantial amounts of money for work that may never be performed, is not needed, or, if performed, involves the use of inferior products (billed at the price for superior products). Most home repair con artists are likely not to be registered in the county or state in which they operate their scheme, making it hard for law enforcement officials to track and arrest them. They often avoid detection by remaining mobile and changing the name of their business and the nature of their repair as they travel from one location to another. These are some common home repair frauds:

Home repair fraud perpetrators often prey on the victims of natural disasters, who are desperate to repair severely damaged homes and businesses. Perpetrators of this type of scam sometimes promise targeted victims that they will be placed in a priority status for repair if they pay a deposit, on the spot, to hold the repair company's time. The perpetrators may say they have been approved by the victim's insurance carrier to do the work and that other estimates are not needed. Additionally, senior citizens are often targeted for home repair schemes because they may have ready cash with which to pay for repairs or to make the required down payment, often live alone, and are socially or geographically isolated from family members. Those conditions reduce con artists' risk of detection and make it unlikely that their references will be verified.

Consumer Protection Tips

8.Identity Fraud

Identity theft is on the rise. Using a variety of methods, criminals steal credit card, driver's license, social security, checking account, savings account, and investment account numbers; ATM, credit, debit, check, and telephone calling cards; and other key pieces of an individual's identity. The thieves use the information to impersonate their victims, spending as much money and accumulating as much debt as they can before being detected. They then move on to their next victim. Even though victims are not normally saddled with paying their imposters' bills, they are often left with a bad credit report and must spend months and even years regaining their financial health. In the meantime, they experience trouble writing checks, securing loans, renting apartments, and even getting jobs.

Commonly Targeted Victims

Any consumer can become a victim of identity fraud if personal and financial information is obtained by fraudulent perpetrators. The risk of victimization is often increased by the following:

Consumer Protection Tips

9.Insurance Fraud

Claiming affiliation with legitimate insurance companies, fraudulent operators sell bogus insurance policies to targeted victims. Bogus policies may be purchased for benefits relating to health care, fire, mortgage, flood, life, disability, funeral, automobile, and other situations. Insurance premiums and claims for reimbursement are paid or presented directly to a fraudulent agent. Premium payments are not paid to the carrier, and claims for payment are not forwarded for processing. Rather the "agent" pays claims with the money he collects from premiums--much like a Ponzi scheme. Insurance fraud such as this can run successfully for a long time before the fraud is detected. This normally occurs when claims exceed the premiums collected, the perpetrator disappears, and the consumer files a claim with the company, only to learn that no such policy is in effect or that for the particular illness is not covered under the terms of the policy.

Commonly Targeted Victims

Consumer Protection Tips

10.Investment Fraud (Including Securities Fraud)

Each year, thousands of consumers put money into investments. Of these investments, the North American Securities Administrators Association estimates that over $10 million is lost to fraud. Investment swindles include land sales, time-shares, securities (stocks and bonds), commodities, futures, gems, precious and strategic metals, franchises and distributorships, oil and gas leases, art, rare coins, and financial planning services.

Investment scams are sometimes sold by direct mail and print and television ads but mostly by phone. Investment fraud perpetrators work from customer lists obtained from legal and illegal sources, or they contact victims who have responded to ads and are requesting additional information. Investment schemes frequently target victims of other fraudulent scams as well--often identified on lists perpetrators sell to each other.

Investment con artists stay abreast of current news and technology trends as they plan their schemes. The key to a successful scam is to make it difficult for the consumer to evaluate inflated claims. For example, the con artist might offer the victim an opportunity to own part of a gold mine. With the price of gold selling for double what it will cost the victim to mine, the profit potential for the victim will be astronomical, the con artist may say. To increase the appearance of legitimacy, he or she may even go so far as to register a claim on an old, abandoned mine and gather an old assay from a time when the mine was profitable. Once the investment is made, the perpetrator absconds with the money or, after hiding the money in an offshore account, declares bankruptcy.

Commonly Targeted Victims

There is no common victim profile. Individuals from all walks of life can be targeted for investment fraud.

Consumer Protection Tips

11.Mail Fraud

Direct mail marketing has been a highly successful and profitable tool for legitimate companies in every conceivable industry and market. The fraudulent perpetrator, however, has copied these direct mail pieces so closely that is often difficult to distinguish the legitimate company from the scam operation. Mail fraud runs the gamut from bogus sweepstakes and free vacations and merchandise to investment opportunities for precious metals. Fraud pieces arrive in the mailbox in all shapes and sizes: postcards, envelopes with official-looking seals, color brochures, letters of endorsement, etc. In a newer mail scam, consumers receive what looks like an invoice for a product or service they have not ordered or received. Fraudulent mail perpetrators hope that targeted victims will not question the "bill" and will mail a payment as directed.

Commonly Targeted Victims

All consumers are at risk for mail fraud.

Consumer Protection Tips

13.Planned Bankruptcy Schemes

A planned bankruptcy scheme is basically a merchandising swindle based on the abuse of credit. In this type of scheme, credit that has been legitimately obtained is used to purchase inventory to sell or otherwise dispose of. Meanwhile, the perpetrator plans to defraud creditors by not paying the bill, loan, or other form of credit, eventually filing for bankruptcy, either voluntarily or involuntarily.

In a typical planned bankruptcy scheme, the perpetrator creates a new business, opens a bank account, and leases operating space to create a front of legitimacy. Operators then begin to order merchandise. The bills for initial purchases are paid promptly to establish a favorable credit rating. Then the operators begin to purchase additional merchandise from new suppliers, while beginning to slow payment to old suppliers. Eventually, increasingly large orders are placed with all suppliers. The increased inventory is then sold below cost, and the profits are concealed. Once the perpetrator receives payment for the merchandise, he or she either absconds with the profits or files for bankruptcy.

In some cases, a planned bankruptcy operator will simply purchase an existing business with a favorable credit rating, thereby eliminating the need to establish a credible business front.

Commonly Targeted Victims

Consumer Prevention Tips

12. Ponzi Schemes

Named after Carl Ponzi, who is thought to have invented the scheme, Ponzi schemes are basically investment frauds where investors are enticed into a business venture with the promise of extremely high returns or dividends in a very short period. The investment is never made, but the Ponzi operator actually pays dividends to initial investors (by returning some of the investors' own money) to make the investment appear credible. The payment of the so-called dividends induces investors to put up additional funds or to bring friends, family members, or business colleagues into the scheme. Once the Ponzi operator has collected sufficient funds for his or her purposes, or fears possible detection, he or she flees the area with investors' money or files for bankruptcy after safely hiding the money. Ponzi schemes can be applied to almost any business or investment.

Commonly Targeted Victims

Consumer Protection Tips

14.Pyramid Schemes

Pyramid schemes may occur when an individual is offered a distributorship or franchise to market a particular product. The investment contract also authorizes the individual to sell additional franchises. Promoters of pyramid schemes stress the selling of additional franchises for a quicker return on the investment to potential investors. Investors, therefore, expend their energies selling franchises rather than the product. At some point, the supply of potential investors is exhausted, leading to the inevitable collapse of the pyramid. The sale of the actual product often fails because it is overpriced or no real market exists for it.

Commonly Targeted Victims

Consumer Protection Tips

15.Real Estate Fraud

Real estate frauds are often earmarked by high-pressure sales tactics that include half-truths, lies, and misrepresentations. Prospective targets receive false information regarding land, locations, value, profitability, validity of title, or the scope, nature, or quality of needed improvements. In warmer climates, real estate frauds are frequently targeted at individuals looking for vacation and retirement properties--though those properties may be underwater or isolated in rural areas without ready access to water and power. In other real estate frauds, potential investors are hooked by claims of valuable mining and mineral rights that do not exist. Real estate investors are also defrauded when they enter into residential and commercial development projects. Money is put up, but the development is never built or goes belly up as the fraud artist walks away with investors' money.

A common ploy used by some real estate fraud perpetrators is to sell bogus time-shares, whereby fraudulent operators place entry blanks and boxes in stores or restaurants offering customers a chance to win a free weekend getaway. After filling out the entry form, the prospective target receives a phone call to schedule an appointment for a high-pressure "sales presentation" or is asked to send in a deposit to hold his scheduled weekend. The deposit is guaranteed to be returned when the targeted victim checks in. Most often, when money is required as part of the free package, the fraud perpetrator absconds with the money, and when the victim shows up for his or her free weekend, the real estate representative pretends to know nothing of the victim's reservation. In other cases, the purchase of a time-share does in fact provide the victim with opportunities to use the property; however, numerous restrictions make it almost impossible to use the time-share as anticipated. For example, the time-share property may be available to the victim only during the off-season.

Today, real estate fraud is big business, and projects of all descriptions and sizes have sprung up throughout the nation.

Commonly Targeted Victims

Consumer Protection Tips

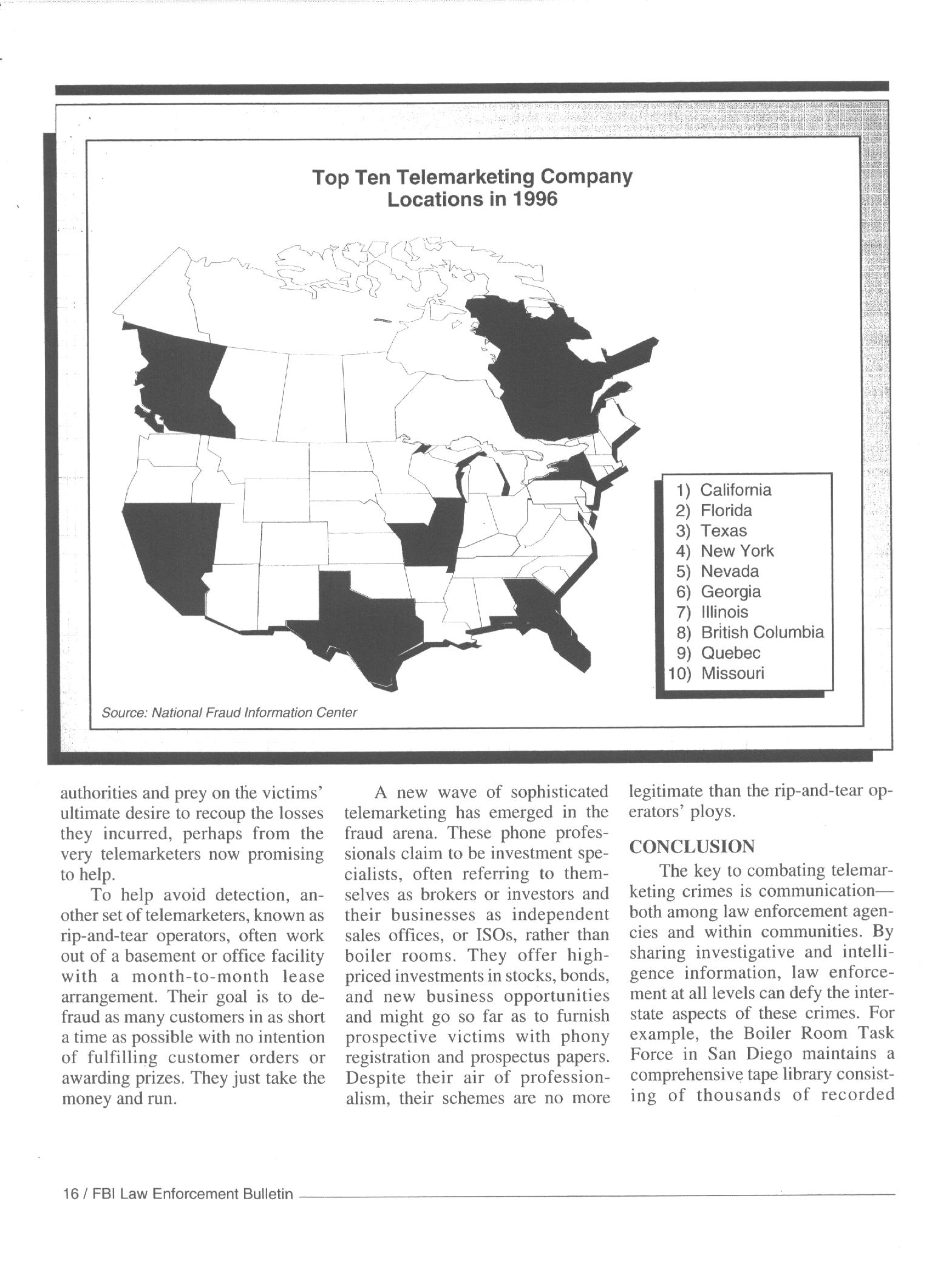

16.Telemarketing Fraud

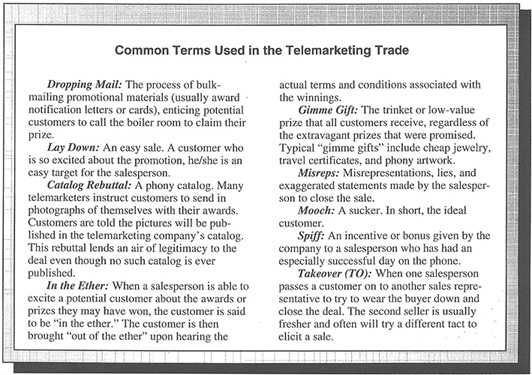

Like direct mail marketing, telemarketing has been a highly successful and profitable tool for legitimate companies to sell products in every conceivable industry and market. The fraudulent telemarketer, like the fraudulent mail marketer, has copied methods and tactics from legitimate companies so closely that it is often difficult to distinguish the legitimate company from the scam operation. Telemarketing scams are often perpetrated in "boiler rooms"--rooms where hundreds of workers call consumers throughout the day to sell fraudulent products, prizes, and investments. They read from high-pressure, carefully worded scripts. Victims may be chosen at random or from carefully compiled lists based on age, geographical location, interests, business or occupation, etc. Operations are mobile to avoid detection or flee prosecution. The following are examples of fraudulent telemarketing schemes:

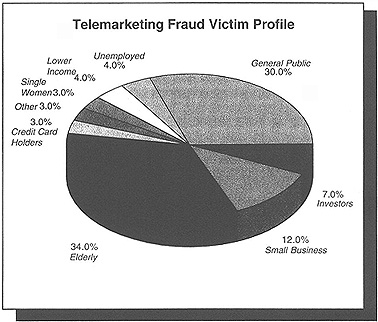

Commonly Targeted Victims

Any consumer is at risk for becoming a victim, but at a higher risk are those who

Consumer Protection Tips

B.Other Examples of Fraud

1.Art Fraud

Fraudulent operators exploit the growing trend to purchase works of art as status symbols and investments. The inexperienced victim purchases what he or she believes to be an original artwork without having the piece appraised or its authenticity verified. The victim often pays an exorbitant amount of money for a fake or for artwork that will never appreciate in value.

2.Bank-Draft Scams

A fraud artist offers a targeted victim anything to get his or her checking account number. Using the checking account number, the fraud artist prints an unauthorized demand draft (used by insurance and other legitimate companies to collect ongoing payments from their customers directly through their checking accounts), and deposits it in the bank. This demand draft allows the fraud artist to directly withdraw money from the victim's checking account. By the time the victim sees his or her next statement, the fraud artist may have depleted the account. Unauthorized bank drafts are very difficult to detect and combat. Because check-processing operations are highly automated, it is nearly impossible for a bank to catch a questionable demand draft.

3.Car-Related Fraud

Con artists in these schemes prey upon consumers who have credit problems and do not qualify for car loans under conventional terms. A typical scheme includes the use of a "credit broker," who charges an advance fee to line up credit for the consumer but instead takes the fee and flees or refers the consumer to a high-interest loan company. Similar schemes involve a "sublease broker," who promises, in exchange for a fee, to arrange for the consumer to "sublet" or "take over payment" on someone else's car loan. Since these types of transactions are illegal in most states and usually violate the original loan or lease, the bank can repossess the car even if the consumer has made all the payments.

4.Diploma Fraud

Career advancement in many instances is tied to educational or degree credentials. Fraudulent operators seize opportunities such as these and open study-at-home courses or set up schools that are not accredited. The operator will claim that his or her school is accredited and that the degrees or certificates are bona fide and ask students to pay tuition in advance. In some cases, the classes provide poor resources and opportunities for study, while in other frauds, the operator takes the advance tuition payment and flees without opening a school at all.

5.Employment Agency Fraud

In this scheme, fraud perpetrators usually advertise in the newspaper and claim to have an outstanding success rate in placing candidates in well-paying, secure jobs--for an advance fee. Once the fee is paid, the fraud perpetrator provides the client with the names of some corporations, which usually have not contracted with or heard of the fraud artist, or provides the client with a list of possible employment opportunities that the fraud perpetrator has compiled from various newspapers' "help wanted" ads.

6.Home Equity Scams

Congress and many states have passed home equity conversion laws that make it easier for older, low-income homeowners to cash in the equity of their homes to increase retirement income or pay off debt. Unfortunately, home equity scams have become one of the fastest-growing frauds. Fraudulent perpetrators refinance mortgages by charging exorbitant interest rates and fees, thus depleting the homeowners' equity. Some consumers cannot make the higher, new payments on their homes and are forced to continue to refinance their homes to meet current payments. Eventually, a homeowner may be unable to keep up with the payments, and the home is lost through foreclosure. Elderly persons are primary candidates for this scheme since their homes have often accumulated high amounts of equity.

7.Phony Inheritance Scams

Thousands of consumers are targeted each year by fraud artists who call themselves research specialists and notify targeted victims that inheritance funds have been located in their names. Victims are then lured into mailing a fee to secure a copy of a fraudulent "estate report," which supposedly explains where the inheritance is located and how it can be claimed. The fraud artist then offers to help the victim file his or her claim to the inheritance for an additional fee. Usually, no inheritance exists, or if one does, the amount is so negligible that it is not worth the fee charged.

8.Work-at-Home Fraud

A victim is lured into this type of fraud by the promise of high pay earned while working in the comfort of his or her home. The victim may also be required to purchase materials and equipment--at high prices--from the fraud perpetrator in order to assemble work products. The typical scam goes like this: A victim purchases the materials needed to complete the job on a promise from the fraud perpetrator that once the product is assembled, he or she will buy it back from the victim and sell it to a well-known retail chain. The victim invests, but the fraud perpetrator never buys the product back from the victim, often closing shop and moving to a new location. The victim is left with products for which there is no market and little opportunity to recoup his or her investment. Work-at-home jobs sometimes involve assembling fiberglass hoods for cars; making aprons, dollhouses, or plastic signs; or stuffing envelopes.

C.Help from Consumer Protection Agencies to Reduce Revictimization

Many consumer protection agencies offer consumer protection tips, fraud fact sheets, and advance warnings of newly identified fraud schemes and practices ("fraud alerts"), which are designed for mass distribution at community awareness events and forums at little or no cost. Many of these resources are printed in both English and other languages and can be found on the Internet.

Victim/witness coordinators may wish to contact the agencies listed below to determine what resources are available and order samples that can be shared with victims, law enforcement personnel, task force members, networking contacts, fraud support group participants, state governmental agencies with mandates to protect the elderly or disabled, and community action groups that have an interest in working with specific populations of potential victims, such as the elderly.

On receiving the resources, victim/witness coordinators may want to consider distributing the materials though a series of community awareness campaigns to address fraud crimes with professionals and community citizens. Local colleges, law enforcement agencies, and state and local consumer protection agencies may wish to co-host such events.

Below is a list of agencies that victim/witness coordinators may wish to contact for resources, pamphlets, public awareness campaigns, newsletters, and other fraud-related resources. Copies of some fraud-related resources are provided at the end of this appendix.

American Association of Retired Persons(202) 424-3410

National Office

601 E St., N.W.

Washington, DC 20049

http://www.aarp.org

Produces a variety of free or low-cost fraud-related materials to reduce the incidence of fraud crime against senior citizens. Publications include fraud alerts, newsletters (Senior Consumer Alert), fraud-specific brochures, and a "Stop Telemarketing Fraud" program kit, which provides information and training agendas for community public awareness campaigns and events.

Call For Action(301) 657-8260

5272 River Road, Suite 300

Bethesda, MD 20816

Provides free written information on avoiding the latest scams and cons.

Consumer Action(415) 777-9648

717 Market St., Suite 310

San Francisco, CA 94103

Federal Trade Commission(202) 326-2222

Bureau of Consumer Protection

Office of Consumer and Business Education

600 Pennsylvania Ave., N.W., Suite 130

Washington, DC 20580

http://www.ftc.gov

Produces a free educational campaign called "Spread the Word . . . About Telemarketing Fraud," which includes resources for use in public awareness campaigns. Those resources include fact sheets; public service announcements; press releases; suggested activities for multi-agency, multi-community plans of action; and order forms for additional fraud-related resources addressing a variety of fraud schemes and practices. Topics include "Automatic Debit Scams," "900 Numbers," "Telephone Investments," "Art Fraud," "Dirt-Pile Scams," and more.

MasterCard International Incorpororated(800) MASTERCARD

2000 Purchase Street

Purchase, New York 10577-2509

National Consumers League(202) 835-3323

1701 K Street, N.W., Suite 1200

Washington, DC 20006

Provides some of its informational, fraud-related consumer brochures free to consumers, such as "They Can't Hang Up--Help for Elderly People Targeted by Fraud," but also, for a fee, produces and disseminates educational resources (videos, reports, etc.) to consumers and professionals who work with fraud victims. For example, NCL has produced a 20-minute video containing personal stories told by fraud victims and helpful advice for seniors and their families, which is available for $20. NCL also runs the National Fraud Information Center (contact information and services listed below).

National Fraud Information Center(800) 876-7060

http://www.fraud.org

A hotline operated by the National Consumers League which consumers across the nation can call to receive advice and tips on how to spot possible fraud and to report it. Prepares and makes available numerous free publications and resources related to fraudulent schemes and practices.

National Futures Association(800) 621-3570

200 West Madison Street, Suite 1600

Chicago, Illinois 60606-3447

Provides free brochures addressing investment fraud, such as the "Investors' Bill of Rights" and "Investment Swindles: How They Work and How to Avoid Them."

North American Securities Administrators Association(202) 737-0900

555 New Jersey Avenue, N.W., Suite 750

Washington, DC 20001

Provides free brochures to consumers about good investing strategies. Also produces informational brochures highlighting investment schemes and practices.

Securities and Exchange Commission(202) 942-7040

Public Information Office

450 Fifth St., N.W.

Washington, DC 20549

http://www.sec.gov

Provides free "Investor Alerts" announcing SEC enforcement actions and warnings about widespread fraud schemes.

U.S. Office of Consumer Affairs(202) 634-4329

1620 L Street, N.W.

Washington, DC 20036-5605

Provides free fact sheets on a variety of fraud-related topics. Also hosts "National Consumers Week" to empower consumers through education and information.

U.S. Postal Service(202) 268-4267

Inspection Services Department

475 L'Enfant Plaza, S.W.

Washington, DC 20260-2100

Provides free tip sheets that highlight current fraud schemes, consumer protection tips, and contact information for verifying the legitimacy of offers, merchandise, or practices with licensing and regulatory agencies. Additionally, the tip sheets provide information about the procedures for filing consumer complaints. The U.S. Postal Service also produces the "Take a Bite Out of Crime" educational and public awareness campaign featuring "McGruff the Crime Dog" and provides these materials free.

D.Additional Resources to Consider

1.National

2.State Resources

3.Local Resources

E.Samples of Fraud-Related Resources

On the following pages are samples of fraud-related resources. Contact information for the providing organizations in listed in Section C, above.

1.American Association of Retired Persons

The American Association of Retired Persons has produced a package called the "Stop Telemarketing Fraud Program Kit." The 80+ page document contains information to help facilitators conduct anti-fraud training. Included are sample agendas; advice on setting dates, times, and locations; materials for distribution; promotional guidance; general talking points; and much more. AARP also produces various fraud alerts and consumer references. Contact AARP at 601 E St., N.W., Washington, DC 20049. (202) 424-3410.

2.Call For Action

3.Consumer Action

4.FBI Law Enforcement Bulletin

5.Federal

Trade Commission

5.Federal

Trade Commission

![]()

![]()

![]()

6.MasterCard

6.MasterCard

7.National

Consumers League

7.National

Consumers League

8.National Fraud Information Center

9.North American Securities Administrators Association, Inc.

10.TRIAD

![]() 11.U.S.

Postal Inspection Service

11.U.S.

Postal Inspection Service

Back to PSVF Table of Contents